Preparing for Christmas payroll – what you need to know

Payroll can get a bit more complex during the silly season, so we’re sharing some special tips for you.

We discuss common payroll pain points and things you should be aware of leading up to the summer break. We’ll touch on points on how to get through and how to run your Christmas pay and key things to remember.

Our Top Tips are:

- Getting it sorted early

- Closedown periods – what are the rules

- Running your Christmas pay — key things to consider

- Working out how much annual leave a team member will accrue by Christmas

- Bonuses and paying out leave

- Working on a public holiday

- When are banks open to process payments?

Now it’s time to get into the detail and make sure you and your payroll team are ready this Christmas.

Get Sorted Early

Leading up to Christmas is often a busy period and the last thing you want to worry about on Christmas Eve is paying your people! Communicate with your team early and get your Christmas break roster locked in. This way you can organise pay cycles and annual leave. Remember, keep it simple!

You’ll want to ask yourself some of the following questions to help prepare:

- Are we closing down during Christmas and New Years?

- Who’s taking leave? What type of leave are they taking? (e.g. annual leave or leave without pay)

- If you’re open, who’s working and when?

- When are the public holidays? Will anyone be working on those days?

- Do I need to run multiple pays in advance of Christmas?

Once you’ve covered off all these questions, and worked out a plan, then it’s important to let your team know, especially if there’s any changes to the norm.

What are the rules in Closedown periods?

Closedown periods are common in a lot of workplaces, and differ between industries and organisations. Some organisations opt to closedown, others decide to stay open. What’s important to remember is that if your business has an annual closedown, you need give your people at least 14 days written notice. This is so the appropriate leave arrangements can be put in place and payroll can be submitted and ticked off.

When you closedown, employees will need to do the following:

- take annual leave while your business is closed down, and

- take leave in advance or leave without pay (agreed) if they don’t have enough annual leave available to cover the closedown period.

- This is only applicable for employees who are entitled to annual leave. Under the Holidays Act, employees not entitled to annual leave at the time of the closedown must be paid 8% of their gross earnings as at the start of the closedown date and their anniversary date for annual leave reset.

Closedown periods often include public holidays. Remember to pay your team if the public holiday falls on a day they’d usually work. Employment NZ has more useful information and tips about closedown periods and annual leave.

Key things to consider when running your Christmas pay

- There’s a few things you’ll want to consider when running your Christmas pay:

- Make sure you’re running a regular pay cycle and don’t mix things up. Set it up in advance so you can manage different periods of leave appropriately.

- Ensure the pay period matches the dates your team member is being paid for.

- It’s common to be considering paying your team leave in advance or leave without pay during the Christmas period. Make sure you and your team are aware of the different types of leave available and how they can use them. Things like Leave Without Pay can add extra steps to your payroll.

- If it all lines up, then you’re good to go. Hit go!

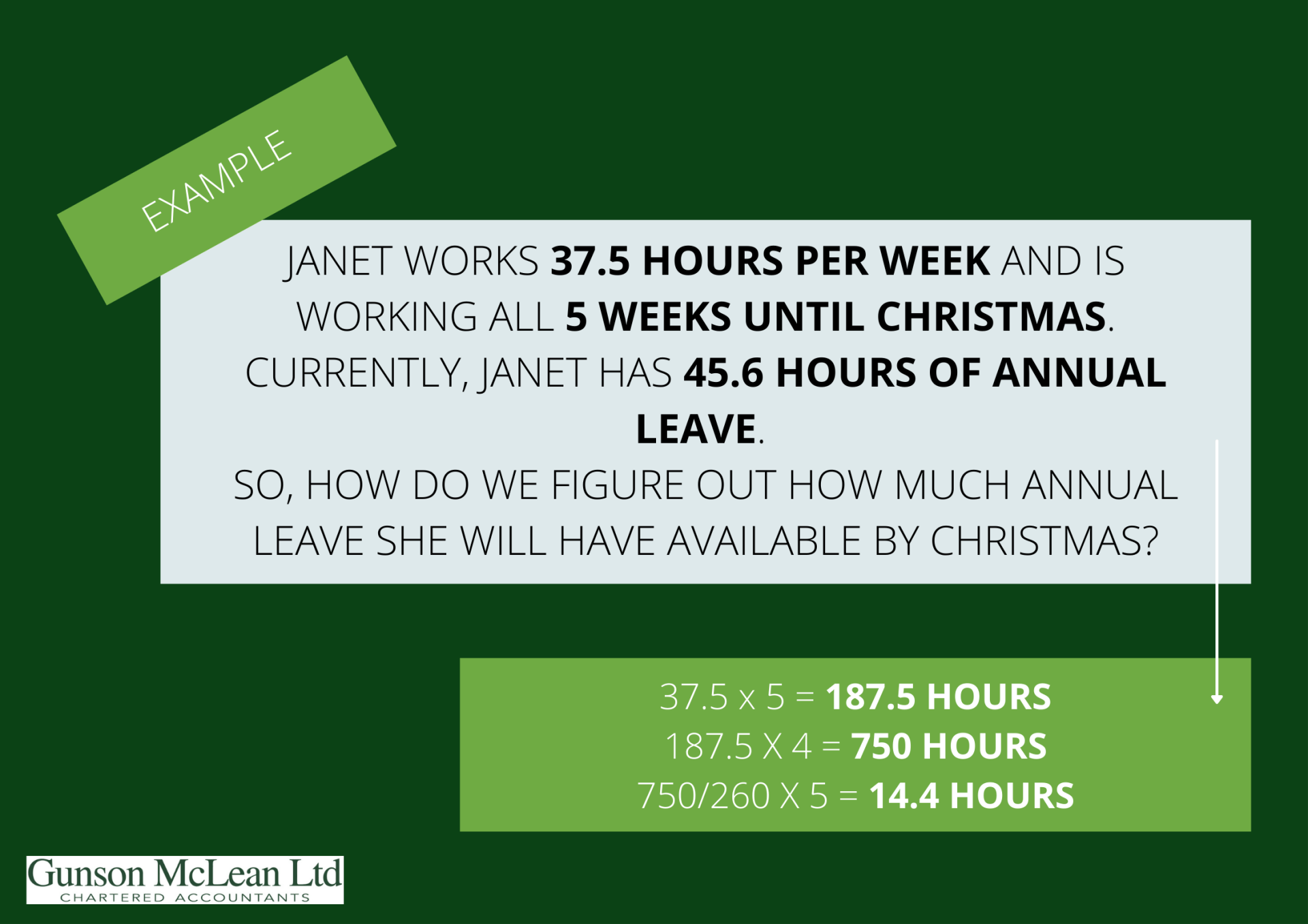

Working out how much annual leave a team member will accrue by Christmas

Everyone wants to know how much leave they’ll have by Christmas. Thankfully, we’ve got a friendly formula for you and your team to use if they’re on standard hours each week. This way you can work out their leave.

For team members on the same standard hours each week (e.g. 37.5 hours)

Here’s a formula to help you work out the amount the employee will accrue between now and Christmas.

[standard work hours] x [number of weeks until Christmas] = [sub-total hours]

[sub-total hours] x 4 = [total hours]

([total hours] ÷ 260) x 5 = [hours of annual leave accrued before Christmas]

For example, with a scenario:

Janet will accrue 14.4 hours of annual leave by the time she reaches Christmas. She’ll have 60 hours (8 days) of leave available to use over the Christmas and New Year’s period.

Note: Your leave balance in hours/days is an approximation only, it’s the leave balance in weeks that will always add to four weeks for every 12 months of consecutive employment. You can read more about leave in weeks here.

Bonuses and paying out leave

Christmas is a common time for businesses to pay out a bonus or cash up annual leave, generally as a lump sum (annual or special bonus). These are considered one off payments and you’ll want to make sure the correct tax is deducted. Most payroll systems should do this automatically for you. If not, here’s a basic guide:

Work out your employees income bracket (e.g. $48,001 to $70,000) and apply the tax rate for that income bracket to the bonus.

To do this:

- Work out what your staff member has earned, before PAYE, over the last 4 weeks.

- Multiply this figure by 13 (or 12 if they are paid monthly).

- Add the bonus (lump sum) amount to the outcome above.

- See what tax bracket this figure sits in (Inland Revenue).

- Deduct the appropriate PAYE amount from the bonus.

Inland Revenue has detailed information about how to get this right, along with information about PAYE tax brackets and secondary taxes.

Tip: In some payroll software, you can reduce the Kiwisaver contribution rate for a specific pay, it could include a lump sum payment. The employee may request this one-off change and then revert back, as long as you agree. For example, if the employee is contributing at 8%, they could drop their contribution rate to 3% for this pay period.

It’s also the time of year for employees to request to cash up annual leave, also considered a lump sum payment. You can follow the same process as above.

A maximum of one week (of an employee’s four-week entitlement) can be cashed out every 12-months of continuous employment. Cashing up annual leave needs to be requested by the employee in writing, and agreed by both parties. The employer may say no. Employment NZ has some useful information about cashing up annual leave.

Working on a public holiday

To determine how your team should be paid when they work on a Public Holiday, you need to check if they usually work on this particular day.

- If the public holiday is their normal working day, the employee should be paid time and a half for the hours worked plus they are also entitled to earn an alternative public holiday (day in lieu).

- If it’s not their normal work day, the employee is only entitled to be paid time and a half for the hours worked.

- An employee doesn’t need to work a public holiday unless they would normally work on this day and it’s stated in their employment agreement. Employment NZ have put together five employment tips for Christmas where they dive into public holidays and other common questions.

When are banks open to process payments?

Payments between banks aren’t processed on public holidays, for example Christmas and Boxing Day. The best way to manage this is to set up payments to go through early and avoid any doubt.

Outgoing and incoming payments:

For example, outgoing payments that normally happen on a Monday (Christmas Day and Boxing Day are observed on Monday and Tuesday 2021) won’t be processed until the next business day, Wednesday.

For incoming payments, you may see money coming through to your account earlier as organisations often setup payments to go through earlier during the Christmas period.